Chinese Makers of Auto Parts Still Earned Better in First Half Despite Car Price Wars

Chinese Makers of Auto Parts Still Earned Better in First Half Despite Car Price Wars(Yicai) July 16 -- Chinese suppliers of car parts managed to improve their profitability in the first six months of this year as auto brands' price wars and cost pressures are only slowly moving upstream.

Among the 50 listed manufacturers of auto parts that released their first-half earnings forecasts as of July 11, 29 recorded enhanced performance, Yicai learned.

Fourteen of the firms said their net profit could have more than doubled. For example, Soling Industrial, a Shenzhen-based developer of smart car software and hardware, expects a more than ninefold surge in gains whereas Huguang Auto Harness, a maker of wiring harnesses, predicts a profit jump of nearly nine times.

The price wars that car brands have been grappling with for a year have not yet spread upstream, an executive at a leading supplier of vehicle parts told Yicai. In the first quarter, prices of components generally remained unchanged from last year. However, discounting pressures could expand in the second half as carmakers could start pushing their growing cost pressures to suppliers, the source predicted.

Still, producers of components that earn a large share of their revenues abroad or have strong electric and smart car businesses could be more resilient to these requests and withstand shrinking domestic incomes to a certain extent due to robust exports and the quickly growing electric vehicle market, the above-mentioned executive added.

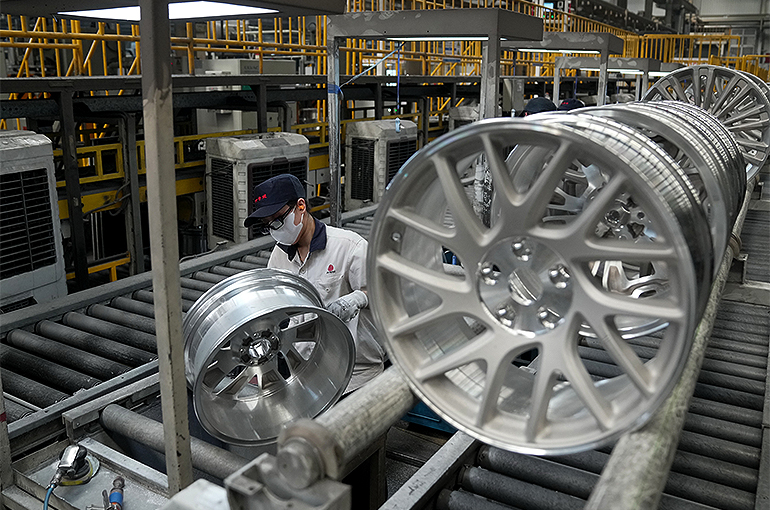

Makers of auto parts rely on exports, electrification, and intelligence for growth. For example, Wencan Group, a supplier of aluminum alloy parts, said that its net profit jumped more than five times in the first half and sales grew due to familiar clients' added output and EV firms' new models. Moreover, NRB, a producer of bearings, said it is likely to have become profitable in the six months as a result of customers expanding production at home and abroad.

Discounting

However, the second half could lead to more discounting.

Under normal circumstances, carmakers may require suppliers to reduce their prices by about 3 percent to 5 percent per year, which has almost become an industry practice, a sales director at a parts company told Yicai. However, besides the regular drop, some car makers started to press for more cuts since early this year, resulting in more discounts, in some cases to exceeding 10 percent overall, the person added.

This year, some carmakers have asked suppliers to slash prices by 20 percent, compared to a usual price cut of 3 percent to 5 percent in previous years, and some even said they would not pay unless the prices fall, Xu Daquan, president of Bosch China, said publicly earlier.

From January to June, China logged only single-digit growth in car sales and production. But the output and sales of EVs surged by 30 and 32 percent year-over-year, respectively, according to the latest data from the China Association of Automobile Manufacturers. In addition, vehicle exports widened by 31 percent.

Editors: Tang Shihua, Emmi Laine