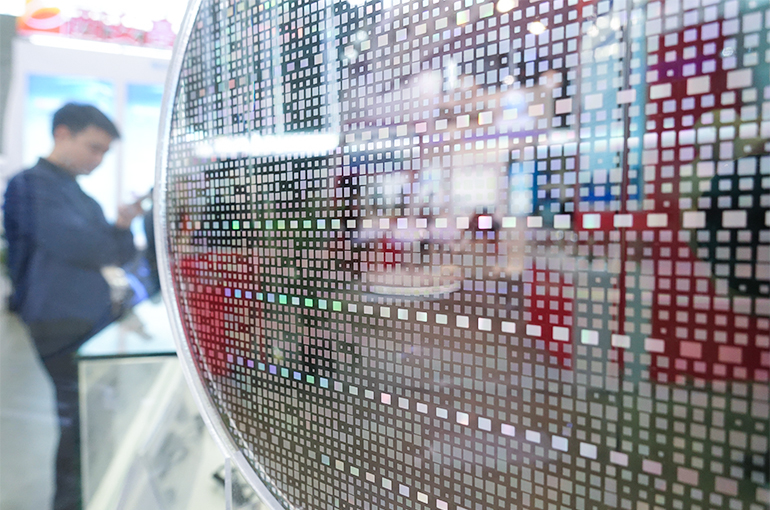

China's Chipmakers Predict Divergent Earnings for 2024

China's Chipmakers Predict Divergent Earnings for 2024(Yicai) Jan. 21 -- Some 64 semiconductor companies listed in the Chinese mainland have released earnings forecasts for last year, with a stark contrast in their predictions.

According to the reports, Rockchip Electronics, Eoptolink Technology, Espressif Systems Shanghai, Forehope Electronic, BOE Technology Group, and Yida Chemical expect net profits to have doubled last year from the year before, with 24 others predicting profit growth. Rockchip's profit has the biggest likely surge at 308 percent to 367 percent.

The success of Fuzhou-based Rockchip and Espressif can be attributed to robust downstream demand for Artificial Intelligence of Things chips, while Eoptolink benefited from increased investment in AI computing power, which significantly boosted demand for high-speed optical modules. Twelve other firms, focusing on product segmentation and with significant market expansion, foresee profits to have jumped over 50 percent.

ASR Microelectronics, Primarius Technologies, and at least eight other companies expect an increase in revenue but not profit, mainly due to fierce market competition and higher research and development costs. Lion Microelectronics and 3PEAK predict net profits to have tumbled 400 percent to 800 percent because of inventory clearance pressure and price wars.

Wingtech Technology, National Silicon Industry Group, Jingjia Microelectronics, and Jingyuntong Technology anticipate to have ended the year in the red without disclosing revenue figures. Jiaxing-based Wingtech likely incurred losses because of the impact of entity list restrictions on its industrial integration business, whereas NSIG and Jingjia Micro saw lower downstream demand.

Overall, the semiconductor sector is showing a pronounced "leader effect," with Cambricon Technologies, Hygon Information Technology, NAURA Technology Group, Advanced Micro-Fabrication Equipment, and BOE, which are among the seven companies with a market capitalization of more than CNY100 billion (USD13.7 billion), expecting positive earnings.

Beijing-based Cambricon predicts to have turned a profit in the fourth quarter of last year due to substantial revenue growth, while Hygon IT expects a jump in both profit and income.

Editor: Martin Kadiev