Chinese Firms Target Nvidia’s Market Share in Smart Driving Chips

Chinese Firms Target Nvidia’s Market Share in Smart Driving Chips(Yicai) Aug. 26 -- Chinese automakers and semiconductor companies are focusing more on the smart driving chip field, to pry market share away from industry leader, the US’ Nvidia.

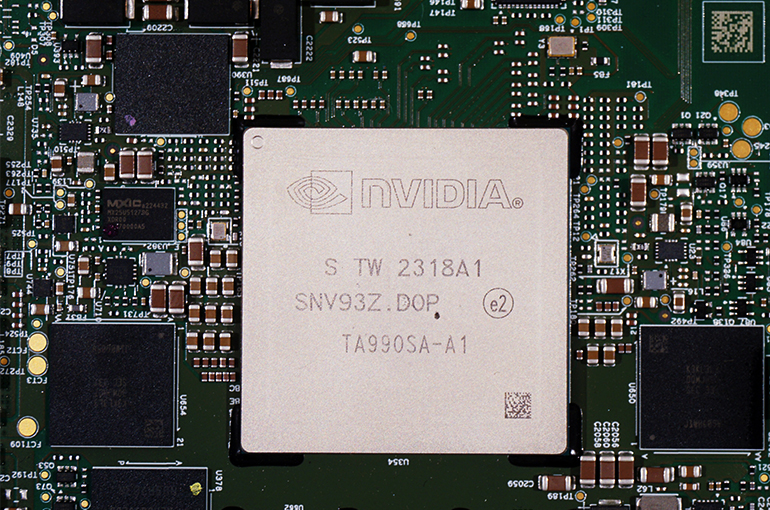

Nvidia's Orin-X chip, which has become the standard for mid-to-high-end Chinese new energy vehicles, had the second highest installed capacity in terms of smart driving domain controlling chips in China last year with sales of 1.09 million and a market share of 33.5 percent share, according to data from the Gasgoo Automotive Research Institute.

The Santa Clara-based firm fell behind US rival Tesla, whose FSD chip ranked first with around 1.2 million shipments, accounting for 37 percent of the market, according to the report. Chinese auto chip startup Horizon Robotics’ Journey 5 chip came third, but it fell far behind the first two with shipments of 200,000 and a market share of 6.1 percent.

Tesla’s FSD chips, though, are mostly used by the US electric car startup while Nvidia's competitors are mostly Chinese. Even though the super computing power of the Orin-X at 254 Trillion Operations Per Second seems indomitable, many Chinese companies are trying to catch up.

In July, Chinese electric car startup Nio released its Shenji NX9031 chip, which is as powerful as four flagship chips in the industry, Chairman Li Bin said. Manufactured using a 5-nanometer automotive-grade technique, it has more than 50 billion transistors.

Xpeng Motors has said it will invest in four AI fields, including semiconductors. And Li Auto is expecting to release its own self-driving chip, the Schumacher, before the end of the year.

Chinese car startups such as Nio and Xpeng are the biggest buyers of Nvidia's Orin chips in China. Nio, Xpeng and Li Auto accounted for nearly 90 percent of Nvidia Orin's sales in the country last year, according to data from Gaogong Industry Rsearch’s smart auto research institute.

Another automotive chip manufacturer Black Sesame Intelligence has said that its next-generation SoC Huashan A2000 should be launched this year. The company is also expanding its automotive-grade chip capabilities, including the further development and commercialization of the Wudang series of cross-domain SoCs, with the goal of achieving mass production by 2025.

Horizon, the current biggest seller of smart driving chips in China, will release its Journey 6 series this year, of which the Journey 6P will reach 560 TOPS. Its target customers include SAIC Group, BYD and other major Chinese car companies.

Huawei Technologies is also entering the market in a big way. Most Chinese EV makers are in talks with the Shenzhen-based company on intelligent driving and smart cockpits, industry insiders told Yicai. The strong brand appeal and good performance of Huawei's advanced driver system are expected to win over more customers in the future.

Editor: Kim Taylor