Chinese Carmakers Persist With Making Own Costly Batteries to Retain Core Technology

Chinese Carmakers Persist With Making Own Costly Batteries to Retain Core Technology(Yicai) Dec. 18 -- There is scant possibility of a universal battery being used across all Chinese electric vehicles, as the nation’s profit-starved automakers insist on making their own core technologies despite the huge investment required.

Chinese automakers are still keen to invest huge sums in developing and producing their own power batteries even though raw material prices have come down and intense price competition in the car market are eating away at profitability, Yicai learned.

“Batteries are one of the core competitive factors for a smart EV maker,” An Conghui, president of Geely Holding Group and chief executive of new energy vehicle brand Zeekr, said at a press conference last week.

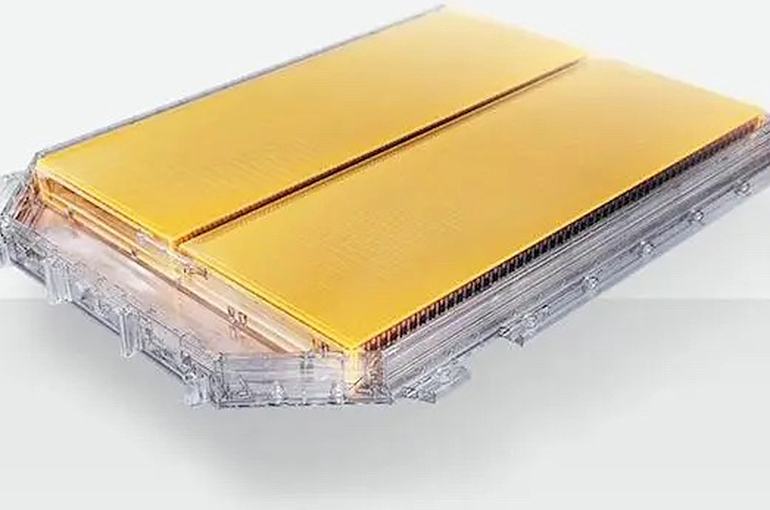

Zeekr's latest Golden Brick Battery will become one of the economic moats for its future development, An said. Unveiled on Dec. 14, the ultra-fast charging 800-volt lithium iron phosphate battery will be produced at Geely Automobile Holdings’ new plant in Quzhou. The plant was finished in just 15 months and cost over CNY10 billion (USD1.4 billion), an employee said.

Moreover, Guangzhou-based GAC Group completed building its CNY10.9 billion battery plant in Yinpai, Guangdong province on Dec. 12.

A senior manager at a leading battery maker told Yicai that the sharp rise in lithium carbonate prices from 2021 to last year made car manufacturers feel insecure and anxious about battery supply, which is one of the reasons why they started making their own. But because the goal is to ensure controllable supply, carmakers are not likely to pursue a completely closed supply chain, they added.

That said, the decision to build battery factories was not automatic but determined by a precarious situation. An said that although Geely began studying battery technologies as early as 2009, the decision to set up its own factory was made just two years ago. That was when supply was so tight that He Xiaopeng, chairman of popular NEV startup Xpeng Motors, was rumored to have hunkered down for about a week at Contemporary Amperex Technology, the world’s largest battery maker, to await his turn.

At present, Zeekr's batteries are mainly supplied by its joint venture with Ningde-based CATL. After the Golden Brick Battery comes on stream, the carmaker will still continue using batteries from the joint venture.

Since battery projects tend to take a long time to break even, they often end up being the first hit when automakers meet hard times. Li Bin, the chairman of NEV startup Nio, said on Dec. 14 that his firm's strategy is to postpone projects that require a high level of fixed-asset investment with a long cycle of returns, such as its own battery workshops.

In keeping with this thinking, Li said that Nio’s latest round of layoffs is not going to impact the its smart vehicle business, but it is expected to greatly affect the firm’s battery production division.

Geely's An is more optimistic. He predicts that Zeekr’s battery business will make its first profit in 2025.

Editors: Tang Shihua, Emmi Laine