China’s Yonghui Drops by Limit After Wanda Unit Stake Buyer Fails to Pay USD509 Million

China’s Yonghui Drops by Limit After Wanda Unit Stake Buyer Fails to Pay USD509 Million(Yicai) Oct. 11 -- Shares of Yonghui Superstores tumbled after the Chinese supermarket chain said the buyer of its interest in a shopping mall management unit of Dalian Wanda Group has missed a more than CNY3.6 billion (USD508.8 million) payment for the stake.

Yonghui [SHA: 601933] fell by its 10 percent exchange-imposed daily trading limit to close at CNY2.91 (41 US cents) a share in Shanghai today.

Dalian Yujin Trading must immediately pay the installment that was due at the end of last month, or Yonghui will take it and the three parties that guaranteed its acquisition of Yonghui’s stake in Dalian Wanda Commercial Management Group to court, the Fuzhou-based seller said yesterday.

Yonghui, one of China’s biggest supermarket operators, agreed last December to part with the 1.4 percent stake for CNY4.5 billion in the face of operating difficulties and financial pressures. Payment was due in eight installments from the end of last year to this September.

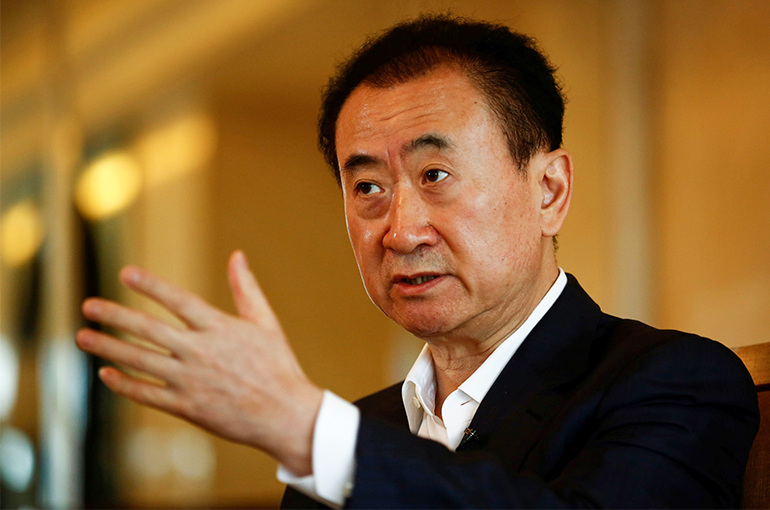

Yonghui paid Yujin Trading's main shareholder Yifang Group CNY3.5 billion for the stake in 2018. Yifang's actual controller Sun Shuangxi is a longtime friend of Wang Jianlin, the former controller of Dalian Wanda Commercial Management.

Wang, who was China's richest person in 2012, 2013, and 2017, is one of the three parties to guarantee Yujin Trading's purchase of the stake. He sold the controlling rights of the shopping mall operator to Abu Dhabi Investment Authority and other investors in March.

Yonghui has been in the red for three consecutive years, having lost over CNY8 billion in the period. In the first half of this year, the firm reported a net loss of CNY275.3 million (USD38.9 million) and revenue of CNY37.8 billion (USD5.3 billion), down 26 percent and 10 percent, respectively, from a year earlier.

Last month, Chinese discount retailer Miniso announced it would invest CNY6.3 billion to buy 29.4 percent of Yonghui from DFI Retail Group and JD.Com to become its largest shareholder.

Editors: Tang Shihua, Futura Costaglione