China’s Upstream Solar Silicon Prices Steady; Downstream Prices Are Still in a Slump

China’s Upstream Solar Silicon Prices Steady; Downstream Prices Are Still in a Slump(Yicai) Sept. 13 -- There have been small signs of an uptick in prices in the upstream of China’s troubled solar industry, after a sustained drop across the supply chain for more than a year after a slew of new capacity came on stream.

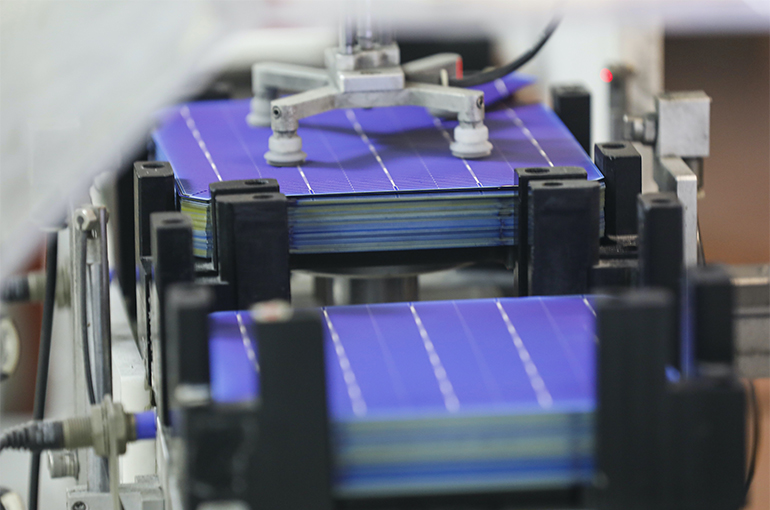

While prices of photovoltaic silicon material, a key product in the upstream supply chain, have shown indications of picking up recently, prices of downstream solar panels remain under pressure.

Transaction prices for N-type polycrystalline silicon, used to make high-efficiency solar batteries, averaged CNY41,600 (USD5,860) per ton over the past week, up 0.73 percent on the week before, according to a report from the silicon branch of the China Nonferrous Metals Industry Association.

But the report noted that the price increase was mainly due to leading solar wafer manufacturers accepting the hike, while small and medium-sized firms mainly remained on the sidelines.

So although the lower end of the silicon price range was much higher than in the prior week, it is still hard to say whether the upswing will be sustained, as many wafer makers still need time to digest their silicon material inventories before buying again, according to a report published yesterday by industry body InfoLink Consulting.

At the same time, the price of silicon wafer, the next link in the supply chain, is also showing signs of an uptick, with Longi Green Energy Technology and TCL Zhonghuan Renewable Energy Technology, two leading silicon wafer vendors, having raised their asking prices since the end of August. But around two weeks after the new pricing, bulk deals have yet to materialize, according to InfoLink’s report.

Both solar wafer and downstream battery firms are mulling price hikes, but without significant improvement in supply further downstream, a sustainable price recovery is unthinkable, the report noted.

Still, Yicai noticed that the drop in downstream PV module prices is still ongoing. For example, the price of high-efficiency N-type solar modules fell to a record low of CNY0.655 (USD0.092) per watt in the most recent bidding round held for energy giant China Huaneng Group’s centralized procurement event.

That shows that price competition remains stiff in the PV module market and the industry as a whole still has not moved on from the price-cutting phase to build market share.

Editors: Tang Shihua, Tom Litting