China's Temu, Other Shopping Apps Spur Global Demand for More Cargo Planes

China's Temu, Other Shopping Apps Spur Global Demand for More Cargo Planes(Yicai) June 28 -- Providers of air cargo transport need to increase their capacity due to rising demand spurred by Chinese shopping platforms such as Temu, according to industry insiders participating in the Transport Logistic China 2024.

Since the second half of last year, e-commerce became the dark horse, He Ying, Cathay Pacific's regional head of cargo, Chinese mainland, said to Yicai during the latest edition of the biennial trade fair that ended yesterday. Particularly, Pinduoduo's Temu drove a quick increase in cargo volume destined for European and American markets. Cathay Pacific transported 10 percent more cargo in the first five months of this year than a year ago, the director added.

By 2027, cross-border e-commerce will contribute almost one-third of global air cargo, up from less than 10 percent a decade ago, largely driven by the needs of Chinese merchants for customers in Asia, the United States, and Europe, said Janson Peng, general manager of the Chinese arm of Southeast Asian logistics provider Teleport.

The gross merchandise volume of China's online shopping platforms that target foreign consumers should double to CNY6.05 trillion (USD833.1 billion) by 2027 from 2022, Peng predicted.

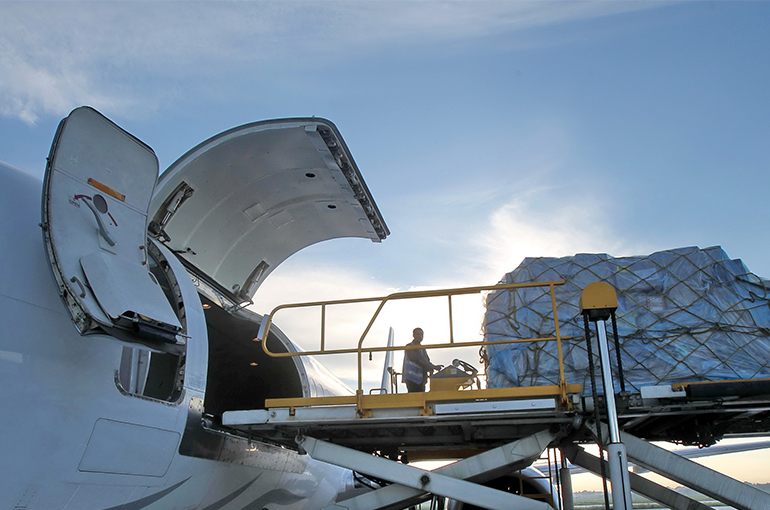

However, logistics providers lack big cargo planes.

Over 120 large cargo planes are over 30 years old globally and will gradually retire but right now there are not enough planes to replace them, Thomas Hoang, regional marketing director at Boeing Commercial Airplanes, said to Yicai. Among Boeing's 777, A350, and 777-8 cargo planes, there is a gap of around 60 aircraft to fulfill the demand in 2027 based on the American company's scheduled orders.

Journey to the East

China's mainland is Asia's biggest air cargo market, and still expanding, Hoang said. Its share rose to 35 percent in 2022, up from 27 percent in 2007.

The market is attracting offshore players. For example, Kuala Lumpur-based Teleport has an expansive cargo network in Asia as the company delivers goods to 85 cities in SE Asia from 19 cities in China, covering four-fifths of SE Asia.

Moreover, Dubai-headquartered Emirates and Addis Ababa-based Ethiopian Airlines transport Chinese products to the United Arab Emirates and Ethiopia and further to other places in the world through passenger and cargo networks.

Hong Kong-based Cathay Pacific operates 34 cargo flights to six mainland cities per week. Moreover, 16 passenger routes carry belly cargo to the mainland.

Editor: Emmi Laine