China’s NEV Battery Industry Is Going Through a Shake-Up Due to Supply Glut, More Curbs

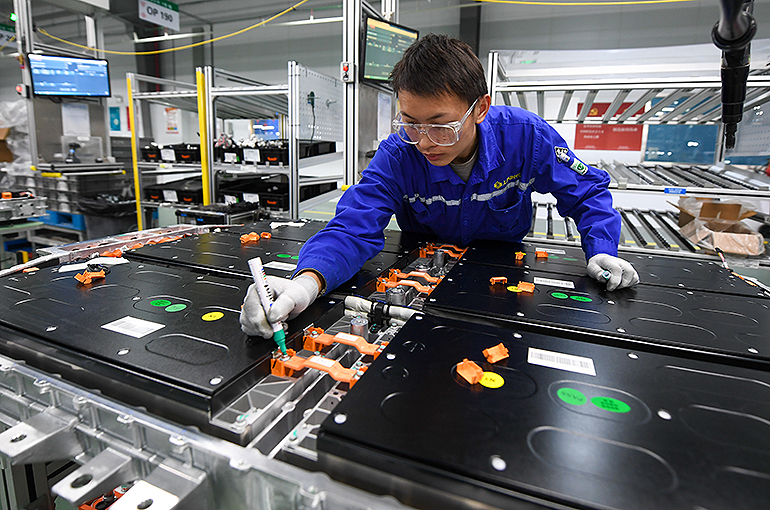

China’s NEV Battery Industry Is Going Through a Shake-Up Due to Supply Glut, More Curbs(Yicai) Oct. 10 -- China’s electric car battery industry is undergoing a rejig as manufacturers struggle with oversupply at home and greater restrictions abroad.

Demand for electric car batteries has been slowing down since the beginning of the year, but battery makers are still hiking capacity, resulting in a supply glut, Yang Hongxin, chief executive of battery maker SVOLT Energy Technology, told Yicai.

China installed 219.2 gigawatt-hours of NEV batteries in the first eight months, around half of the 419.7 GWh that were produced, meaning that there was an oversupply of 200 GWh worth of batteries, according to statistics from the China Automotive Power Battery Industry Innovation Alliance.

This happened when battery makers were not operating at full capacity. Industry leader Contemporary Amperex Technology, for example, was only operating at 60.5 percent capacity in the first six months, producing 154 GWh of batteries, the alliance said.

Yet while there is overcapacity of older versions of batteries, the latest batteries such as 800-volt ones are in short supply, Yang said. This means that companies that do not upgrade their facilities or which invest in the wrong fields are in danger of being left behind, he added.

An oversupply of conventional batteries is likely to lead to a reshuffle in the industry which will consolidate the position of leading companies, China Merchants Securities said in a recent research report. Demand for electric car batteries will continue to rise and there is good long-term potential.

More Curbs

Due to the bottleneck at home, many battery makers are seeking opportunities abroad. CATL, SVOLT, EVE Energy,and CALB have all built factories overseas, mainly in Europe. And it used to be a profitable venture. For instance, Volkswagen-backed Gotion High-Tech’s overseas revenue quadrupled in the first half from the same period last year to CNY3.1 billion (USD433.2 million).

However, new regulations are making this route harder. The EU’s latest subsidies on battery manufacturers have some new requirements, Yang said. NEV and battery makers must acquire the Conformite Europeenne certification which will greatly hike costs. And at least 60 percent of materials must be sourced in Europe from 2027.

The hardest stipulation to meet is buying battery anode materials in Europe, Yang said. It is difficult to build anode materials plants in the EU due to high power consumption and dust issues in the production process. Besides, Europe-made batteries will cost more than China-made ones even if the 60-percent-procurement requirement is met, he added.

The EU Battery Law, which will come into force in February next year, will also make it more difficult for Chinese battery makers to go global. The law has specific requirements on sustainable development such as carbon footprint, battery recycling, the re-use of recycled materials and due diligence. It also puts forward the concept of a “battery passport”.

Batteries sold to Europe must adhere to the EU Battery Law, so production costs will rise in the short term, which will hinder small and medium-sized businesses, said Yu Qingjiao, secretary general of the Zhongguancun New Battery Technology Innovation Alliance and president of CBHA.

In the long run, the law will lead to a reshuffle in the battery industry and promote a worldwide low-carbon transition, Yu said.

Editors: Tang Shihua, Kim Taylor