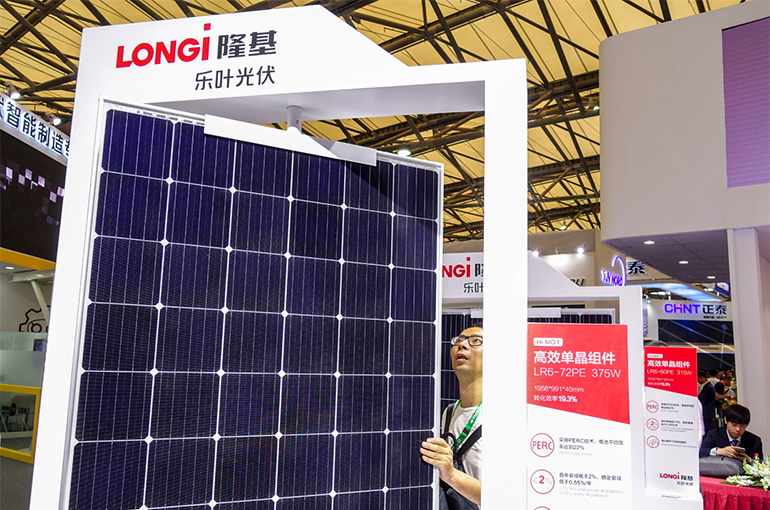

China’s Longi Cuts Solar Wafer Prices Again as Silicon Prices Tumble

China’s Longi Cuts Solar Wafer Prices Again as Silicon Prices Tumble(Yicai Global) May 31 -- Longi Green Energy Technology, the world’s largest supplier of monocrystalline solar wafers, has slashed the price of its photovoltaic wafers by 30 percent this month, its second price cut in two months, as an oversupply of polysilicon, a key raw material used to make wafers, floods the market.

Longi trimmed its prices 3 percent in April. This month it reduced them much more sharply as polysilicon production continues to increase, bringing down prices, Yicai Global learned from several sources in the photovoltaic industrial chain.

“In anticipation that raw material prices will continue to fall, silicon wafer manufacturers are cutting prices or producing less in order to destock, but there will still be surplus wafer supply in May,” an industry source told Yicai Global.

As more and more new capacity come online, the price of polysilicon has more than halved so far this year to CNY140,000 (USD19,702) per ton from CNY300,000 per ton at the end of 2022.

“And prices may drop further,” said the source. “This is largely because wafer makers are only buying the silicon they need to meet their current orders as they are very cautious now that the price of raw materials is dropping rapidly. This only exacerbates the oversupply and hence prices keep falling.”

Silicon inventories are still building up. The current spot inventory is close to or has reached the size of the total monthly production of silicon producers, so the pressure on silicon sales is not likely to improve in June, according to data from InfoLink.

Wafer prices are expected to continue to slide, mainly due to the large inventories accumulated by producers when wafer prices were high, CITIC Futures said in a recent report. But the decline in wafer prices could be smaller than that in silicon prices, so it is still possible that wafer makers can have a better gross margin this year than in 2022 even though they keep cutting their prices, the report added.

“Downstream cell and panel producers are expected to benefit greatly from this round of price cuts as their inventories are at a much more reasonable level and the pressure on shipments is less,” a person engaged in the development of photovoltaic power plant business told Yicai Global. The decline in the average price of cells is smaller than that of upstream products, he added.

Editors: Tang Shihua, Kim Taylor