Chinese Foundry Hua Hong Confirms STMicro Tie-Up

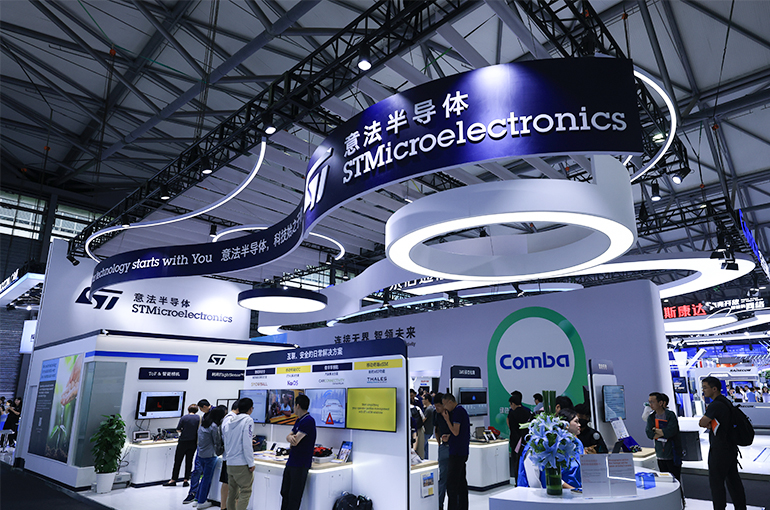

Chinese Foundry Hua Hong Confirms STMicro Tie-Up(Yicai) Nov. 21 -- Hua Hong Semiconductor, the second-largest wafer foundry on the Chinese mainland, confirmed that it is partnering with European chip giant STMicroelectronics on production in China.

An official announcement will follow, the Shanghai-headquartered company told Yicai today.

During an investor event yesterday, STMicro announced that the Geneva-based contract manufacturing and design firm would partner with Hua Hong to better serve Chinese customers. They plan to produce 40 nanometer microcontroller chips in Shenzhen starting next year, it added.

"China for China" is one of STMicro's critical strategies to enhance market competitiveness, according to Chief Executive Jean-Marc Chery.

"If we give up our market (share) in China to another company working in the field of industrial or in the field of automotive, the Chinese players, they will dominate their market," Reuters reported yesterday, citing Chery. "And their domestic market is so huge, it will be a fantastic platform for them to compete in other countries.”

STMicro, whose clients include Tesla and Geely Holding Group, operates nearly 15 wafer production and testing facilities across France, Italy, Singapore, the Philippines, and Malaysia.

There are multiple reasons to manufacture in China, including local supply chains, compatibility, and minimal government restrictions, Reuters noted, citing Fabio Gualandris, STMicro's head of manufacturing.

This is not STMicro's first China venture. Last year, it partnered with Sanan Optoelectronics to set up a wafer manufacturing joint venture in Chongqing. The facility will produce 8-inch silicon carbide chips with an initial capacity of up to five kilowatts per wafer, eventually scaling up to 10 kilowatts. STMicro has also set up a packaging and testing plant in Shenzhen.

STMicro has postponed its target of achieving USD20 billion in revenue to 2030 from 2027, citing increased competition as a significant factor.

Hua Hong's stock price [SHA: 688347] rose 0.9 percent to CNY48.64 (USD6.70) in Shanghai today.

Editor: Emmi Laine