China’s Horizon Robotics Seeks Up to USD695 Million in Hong Kong IPO

China’s Horizon Robotics Seeks Up to USD695 Million in Hong Kong IPO(Yicai) Oct. 18 -- Horizon Robotics, a leading Chinese developer of self-driving technology, aims to raise as much as HKD5.4 billion (USD695 million) from its initial public offering in Hong Kong, which would make it the city’s biggest IPO so far this year.

Horizon plans to sell 1.36 billion shares priced in the range of HKD3.73 to HKD3.99 (48 US cents to 51 US cents) each, the Beijing-based firm said in a bourse filing on Oct. 16. It will begin trading on the Hong Kong Stock Exchange on Oct. 24 under the stock ticker [HKG: 9660].

Its market debut will be closely watched, particularly given Horizon’s strategic tieups with major auto and tech giants such as Volkswagen Group, Alibaba Group Holding, and Baidu and the growing importance of autonomous driving tech in China's push toward smart electric vehicles. The stock price of main rival Black Sesame has fallen since its IPO in August.

Shares of autonomous vehicle chipmaker Black Sesame International Holding [HKG: 2533] opened nearly 33 percent down at HKD18.80 (USD2.42) on their Hong Kong market debut on Aug. 9. They are still 13 percent below their IPO price of HKD28.

The cornerstone investors in Horizon’s IPO are Alibaba unit Alisoft China Holding, Baidu's Hong Kong arm, a company under Merit France, and an investment fund backed by the Ningbo government. Together, they will invest USD219.8 million.

Goldman Sachs, Morgan Stanley, and China Securities International are the IPO’s joint sponsors.

Since its establishment in 2015, Horizon has completed 11 financing rounds, raising a total of over USD8.7 billion from pre-IPO investors such as Chinese carmakers SAIC Motor and BYD, private equity giant Hillhouse Investment, and venture capital firm Sequoia Capital.

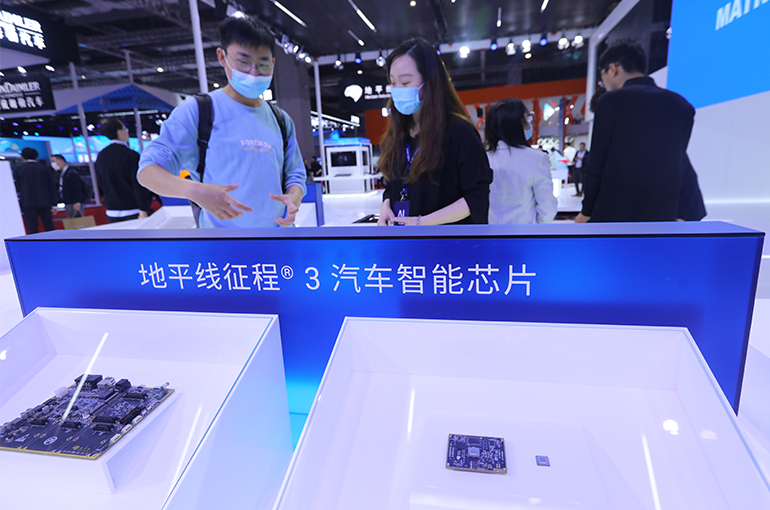

Horizon was China's fourth-largest provider of advanced driver assistance systems and autonomous driving solutions by installed capacity last year and in the first half of this year, according to China Insights Consultancy. Its revenues and gross profit margin have increased in recent years, but the firm’s net losses have widened on high research and development costs.

Revenues were CNY910 million (USD127.8 million) in 2022 and CN1.5 billion (USD210.6 million) last year. In the six months ended June 30, income was CNY935 million, up 152 percent from a year ago. Gross profit margin was 69 percent, 71 percent, and 79 percent, respectively, in the three periods.

However, the company's net losses have been shrinking, coming in at CNY8.7 billion in 2022, CNY6.7 billion last year, and CNY5.1 billion in the first half of 2024. R&D spending accounted for 208 percent, 153 percent, and 152 percent of revenues over the three periods.

Last November, Horizon set up a joint venture with German carmaker Volkswagen's auto software subsidiary Cariad. Horizon owns 40 percent of the JV, and Cariad the rest. Cariad was Horizon's largest customer last year and in the first six months of this year, contributing 40 percent and 38 percent, respectively, to the company's revenues in the periods.

Editor: Futura Costaglione