China’s Key Economic Meeting Paves Way for Earnings Growth, Economist Says

China’s Key Economic Meeting Paves Way for Earnings Growth, Economist Says(Yicai) Dec. 13 -- Positive signals from the top-level meeting that sets China’s annual economic agenda indicate that the economy is expected to keep recovering next year, which should be a boon for corporate earnings, according to the chief economist at Haitong Securities.

Based on the two-day Central Economic Work Conference that concluded yesterday, the government is expected to step up countercyclical and cross-cyclical adjustments to its macroeconomic policies in 2024, Xun Yugen told Yicai.

The government will continue with a moderately proactive fiscal policy and a flexible and moderate monetary policy, which are both vital to consolidating the foundations of the economic recovery, he added.

As a result, the combined net profit of Chinese mainland-listed companies will increase by 5 percent to 10 percent next year, Xun predicted.

As US interest rates begin to come down next year and the external business environment starts to improve a little, the market value of Chinese businesses will rise and foreign capital will start to flow back into China, Xun said. Driven by these positive factors, mainland stocks will be presented with new opportunities in 2024, he added.

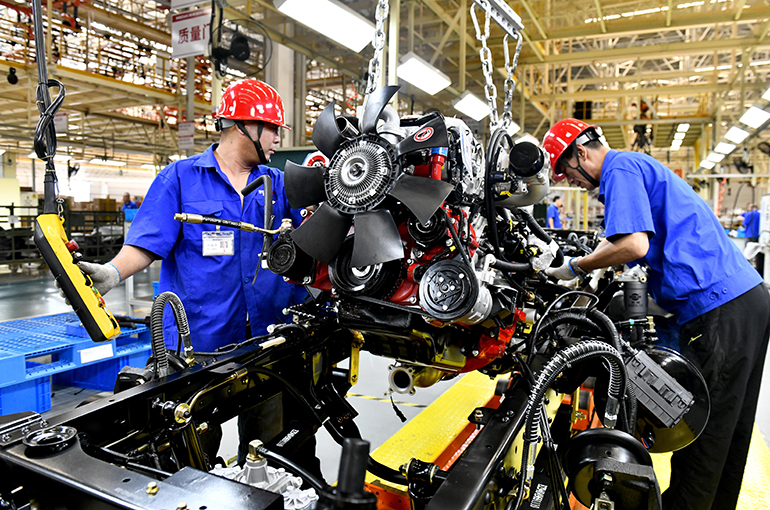

The Central Economic Work Conference clarified the driving force of future economic development and stressed that the nation should build a modern industrial system based on scientific and technological innovation, Xun said.

It also emphasized that China should improve the resilience and security of industrial and supply chains, develop the digital economy, and accelerate the development of artificial intelligence, he added.

Following the meeting, China is expected to speed up the building of affordable housing and public infrastructure as well as the rebuilding of urban villages, effectively hedging the slump in the property market and stabilizing economic conditions, Xun noted.

Haitong Securities is a Shanghai-based brokerage and investment bank.

Editors: Dou Shicong, Emmi Laine