China’s Empyrean Soars on Plan to Take Over Fellow Chip Design Tool Maker Xpeedic

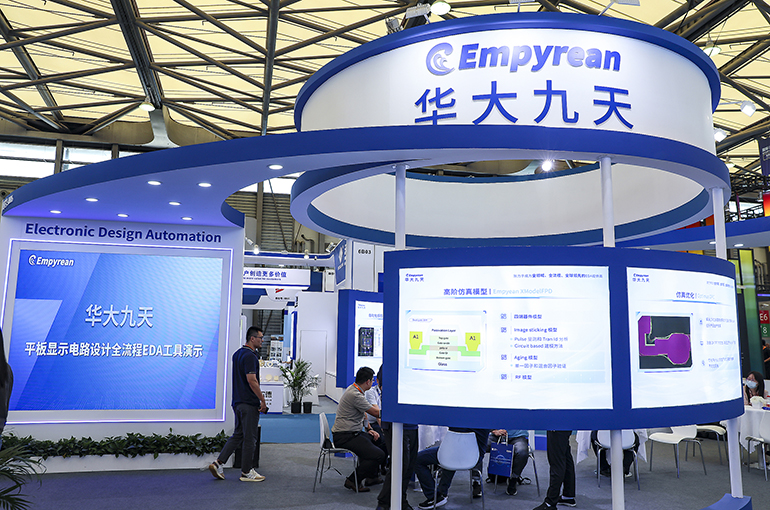

China’s Empyrean Soars on Plan to Take Over Fellow Chip Design Tool Maker Xpeedic(Yicai) March 31 -- Shares in Empyrean Technology jumped today, bucking the downward trend of the stock markets, after the Chinese electronic design automation software developer said it plans to acquire Xpeedic, a peer company in the integrated circuit design sector, to strengthen its product portfolio and attract more customers.

Empyrean’s share price [SHE: 301269] closed up 3.5 percent at CNY115.45 (USD15.90) on its first day of trading after a two-week-long suspension. Earlier in the day, the stock surged more than 7 percent to CNY122.86. This was in stark contrast to the Shenzhen stock exchange’s ChiNext Board, on which Empyrean is listed, which closed down 1.1 percent.

Empyrean will acquire 100 percent of Xpeedic’s equity through a mixture of cash payments and share issuances, according to the firm's asset acquisition proposal released on March 30. The final transaction price has not yet been determined, as Xpeedic is still undergoing an audit and asset evaluation, but the acquisition is expected to constitute a major restructuring of assets, it added.

Xpeedic is a leader in EDA, which is a type of software that helps design, manufacture, package and test very large integrated circuit chips using computer assistance, in China. It offers a full range of electronic simulation platforms and solutions, covering everything from chip design to packaging, and has over 200 research staff. The firm has developed several EDA products that are already being used commercially.

Empyrean is committed to becoming one of the world’s top EDA providers, and mergers and acquisitions are a key part of its growth strategy, the Shanghai-based firm said. The acquisition will fill gaps in its product portfolio, as Xpeedic has strong complementary advantages in fields like analog RF chips, power devices and memory chips.

After the deal, both companies will share customers and build a more complete product chain and ecosystem to boost their overall competitiveness.

Xpeedic is expecting to rake in profit of CNY48.1 million (USD6.6 million) in 2024, a big turnaround from losses of CNY89.9 million in 2023, according to the report. The Shanghai-based firm is anticipating revenue to surge two-and-a-half-fold last year from the year before to CNY256 million (USD35.3 million).

Editor: Kim Taylor