China's Central Bank Conducts Record USD159 Billion 14-Day Reverse Repo Operations

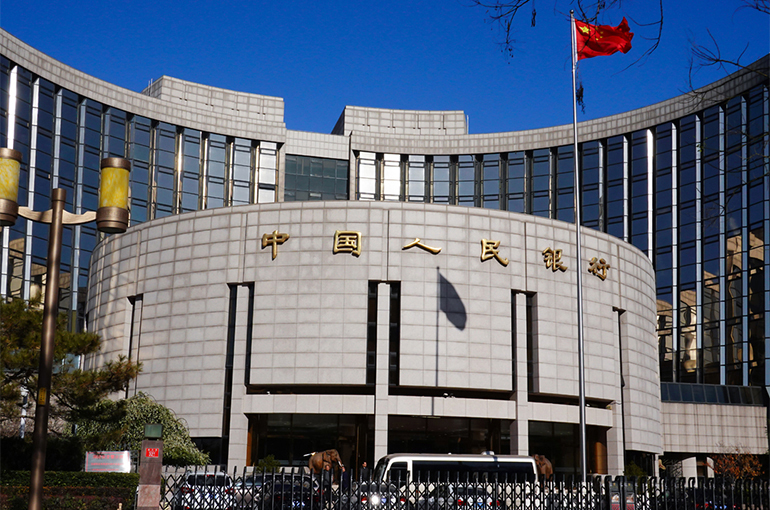

China's Central Bank Conducts Record USD159 Billion 14-Day Reverse Repo Operations(Yicai) Jan. 22 -- The People’s Bank of China has conducted CNY1.1575 trillion (USD159 billion) 14-day reverse repurchases the day after such operations resumed, setting a new record.

The central bank injected CNY198 billion (USD27 billion) of net liquidity into the market through 14-day reverse repo operations today, as CNY959.5 billion were due to expire. The 14-day reverse repurchases rate stayed unchanged at 1.65 percent.

The PBOC’s move aims at offsetting the expiration of seven-day reverse repos and injecting liquidity into the market ahead of the Chinese New Year holiday to prevent significant fluctuations in fund availability, said Wang Qing, chief macro analyst at Golden Credit Rating.

"As the PBOC has already conducted outright reverse repo of CNY1.4 trillion last month, releasing a large amount of medium-term liquidity into the market, the upcoming MLF operations on Jan. 26 will likely be much smaller, thus continuing to diminish the role of the MLF rate as a policy interest rate,” Wang noted.

“Given the current liquidity arrangements, bond market regulations, and the macroeconomic situation, the likelihood of a reserve requirement ratio cuts before the Chinese New Year holiday is low," Wang added.

Editor: Futura Costaglione