BYD Seal Has 35% Cost Edge Over European EVs, UBS Report Says

BYD Seal Has 35% Cost Edge Over European EVs, UBS Report Says(Yicai) Sept. 5 -- Chinese carmaker BYD’s Seal, a mid-size electric sedan available in Europe, has a 35 percent cost advantage over other European electric vehicles, according to a teardown report by UBS Evidence Lab, the Swiss bank’s data science division.

The Seal has 25 cost advantages over its European counterparts, even taking tariffs and freight into consideration, and is 15 percent cheaper to make than the Tesla Model 3, thanks to BYD’s vertically integrated component system and advanced technology, the report said.

The auto giant revealed the launch of the Seal in the European market on Sept. 4. The model’s 550-kilometer and 700-km range versions are priced at EUR44,900 and EUR50,990 (USD48,165 and USD54,700), respectively, which makes them 43 percent and 84 percent more costly than in China.

The gross profit margin on the Seal is about 16 percent, and the model’s earnings before interest and taxes are 5 percent, similar to combustion-engine cars in the mainstream global auto market, said Paul Gong, head of China autos research at UBS.

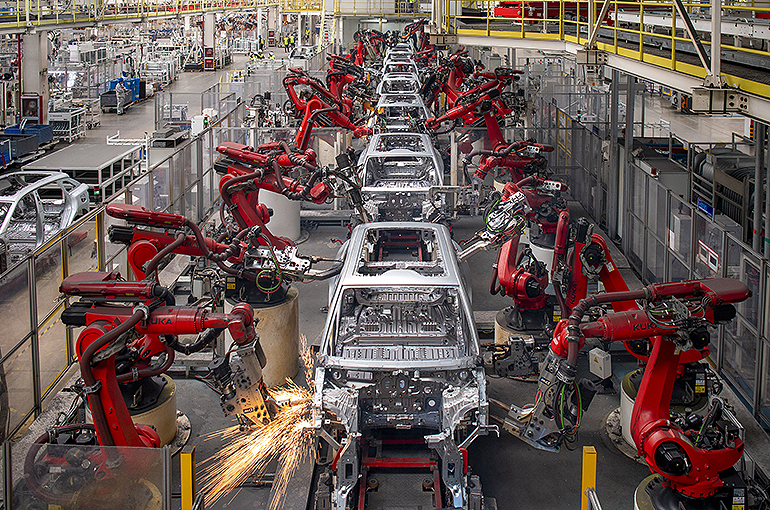

Seventy-five percent of the Seal’s components, including the battery, are produced by Shenzhen-based BYD, according to the teardown report. Only some come from external suppliers, including some Qualcomm auto chips.

Compared with Tesla’s Model 3, which is similar in size to the BYD Seal, the Chinese car has more interior space, a better onboard entertainment system, and vehicle networking. But in terms of acceleration, top speed, and self-driving assistance system, the vehicle is relatively not as good.

Western carmakers are expected to lose about a fifth of their global market share as cheaper and more cost-effective Chinese EVs take over, the UBS report said.

By 2030, Chinese producers will have about 33 percent of the global auto market, up from 17 percent last year, thanks to their edge in electrification, while their Western counterparts will see their share drop to 58 percent from 81 percent, it said. Tesla’s will rise to 8 percent from 2 percent.

Regionally, Chinese brands will account for 80 percent of the Chinese market by the end of the decade and increase their slice of the European market to 20 percent from 3 percent. UBS also predicted that in the United States, Japan, South Korea, and India, markets that are hard to break into, China’s auto firms will have less success, garnering just 30 percent.

Editor: Futura Costaglione