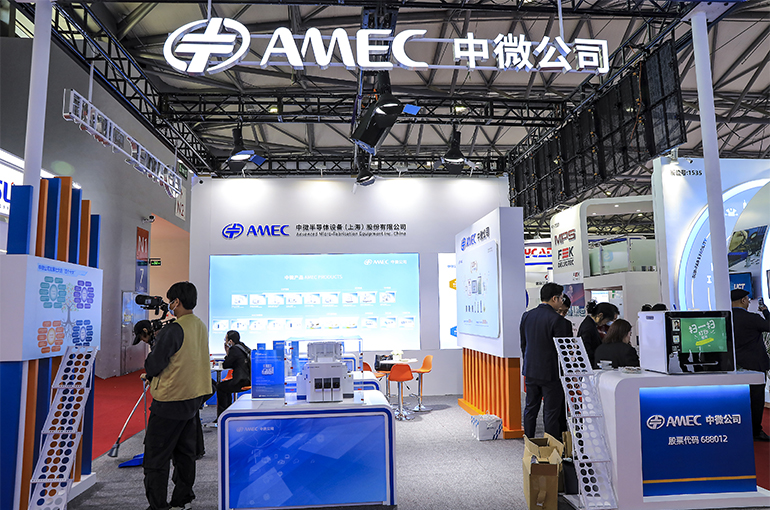

China’s AMEC Climbs On Plan to Invest USD409 Million to Build Chip Gear Factory in Chengdu

China’s AMEC Climbs On Plan to Invest USD409 Million to Build Chip Gear Factory in Chengdu(Yicai) Jan. 15 -- Shares in Advanced Micro-Fabrication Equipment advanced as much as 2.8 percent today after China’s largest chip etching equipment supplier said that it will invest CNY3 billion (USD409 million) to construct a new production base in Chengdu, southwestern Sichuan province for the R&D and manufacturing of high-end logic and memory chip production equipment.

Despite the promising start to the day, AMEC’s share price [SHA:688012] closed down 1 percent at CNY186.39 (USD25) due to the weak performance of the major stock indexes. Earlier in the day it hit CNY193.88.

AMEC will build its southwest headquarters in Chengdu, as well as a production base, R&D center and supporting facilities, the Shanghai-based company said yesterday. Construction is expected to start this year and be completed by 2027. Annual sales should reach CNY1 billion (USD136.3 million) by 2030.

AMEC, which mainly makes plasma etching and thin film deposition equipment used in chip production, currently has factories in Shanghai’s Jinqiao district and Lingang Special Area as well as Nanchang in eastern Jiangxi province.

AMEC also released a healthy performance forecast for 2024 yesterday. Strong sales of its high-end plasma etching and thin film deposition equipment are likely to have driven revenue up 44.7 percent year on year to CNY9 billion (USD1.2 billion), according to the unaudited report.

Net profit, however, is expected to tumble between 4.8 percent and 16 percent to between CNY1.5 billion (USD204.5 million) and CNY1.7 billion, due to the sale of a stock asset in 2023 which raised the baseline, the report said. Therefore, its net profit after deducting non-recurring gains for the year is expected to jump between 7.4 percent and 20 percent to between CNY1.2 billion (USD174.5 million) and CNY1.4 billion.

AMEC's R&D expenditure nearly doubled last year from the year before to CNY2.4 billion (USD327 million), accounting for 27 percent of total revenue, the report said.

Editors: Tang Shihua, Kim Taylor