China Turns Into Global Gaming Powerhouse as Overseas Revenue Jumps

China Turns Into Global Gaming Powerhouse as Overseas Revenue Jumps(Yicai) Jan. 16 -- China has established itself as a major force in the global video gaming market, notching up substantial growth in overseas gaming revenues last year, according to multiple rankings and reports.

Overseas sales of Chinese games rose 13.4 percent to USD18.6 billion last year, per a report released last month by the Game Publishing Committee of the China Audio-Video and Digital Publishing Association and Gamma Data.

Most of that came from the United States, Japan, South Korea, Germany, and the United Kingdom, with the first three markets accounting for 31 percent, 17.3 percent, and 8.9 percent, respectively, the report said. Saudi Arabia also entered the top 10, as China’s market penetration gains in other regions.

As global gaming industry growth slows, mid-to-light spec titles are becoming the new trend in overseas expansion, Tang Jiajun, deputy secretary-general of the CADPA and secretary-general of the Game Publishing Committee, said at an industry conference. Developers are also increasingly inclined to make simpler, lower-cost, and more compact lightweight games, Tang added.

Last November, 61 of the top 100 highest-grossing mobile games worldwide were made by Chinese developers, data from market intelligence firm Sensor Tower showed. In addition, 34 Chinese mobile game publishers ranked among the top 100 by revenue last October.

A report from Singaporean tech platform Mobvista also showed that Chinese mobile games accounted for about 7 percent of downloads among the global top 5,000 in the second half of last year.

Standout Games

Whiteout Survival, developed by Beijing-based Century Games, remained at the top of Sensor Tower's list of successful Chinese mobile games abroad last month. The strategy game has grossed more than USD1.8 billion worldwide since being released in 2023, with 88 percent of its income coming from overseas markets.

Legend of Mushroom, an action-adventure role-playing game published by 4399 Network, earned USD378 million abroad in the first six months of last year, a report by DataEye and DianDian showed. Tencent Holdings, a colossus in the field, reported a 9 percent jump in overseas gaming revenue to CNY42 billion (USD5.7 billion) in the three quarters ended Sept. 30 from a year earlier.

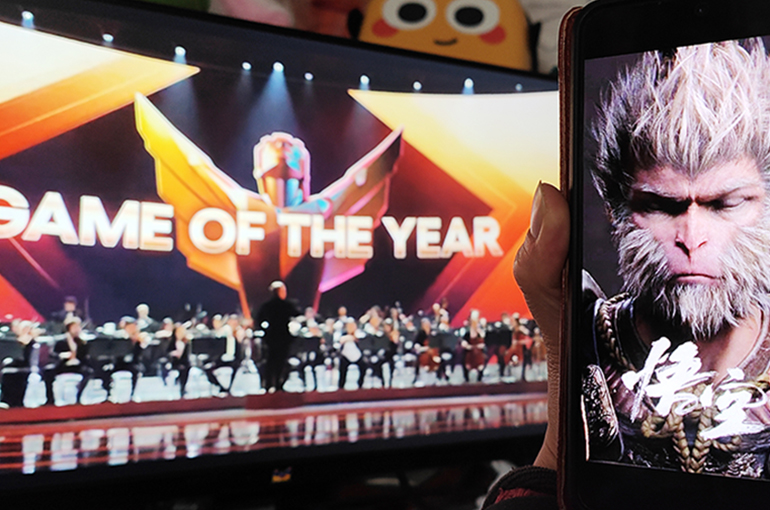

Black Myth: Wukong, the hit action role-playing game from Shenzhen-based Game Science, sold around 28 million copies last year, racking up sales of CNY9 billion (USD1.2 billion). Overseas players accounted for about a quarter of the total, according to data analytics site Gamalytics.

But global competition gets tougher by the year, and Chinese game developers face a gamut of challenges. The unstable economic environment and the complexities of regional markets can hinder the overseas expansion of small and medium-sized companies, while on a micro level difficulties in acquiring users, soaring marketing costs, and localization barriers are widespread.

Europe, Southeast Asia, and North America are the hot spots for mobile game advertising, a Mobvista spokesperson noted. SE Asia remains the largest customer acquisition market for Chinese brands, while the South Asia and Central America markets are relatively easier to grow in, the person added.

To monetize their products, brands increasingly view in-game advertising as an effective method, with the in-app advertising model showing much revenue potential, he pointed out.

Editor: Martin Kadiev