China’s Solar Firms Feel the Pinch as Raw Material Prices Soar

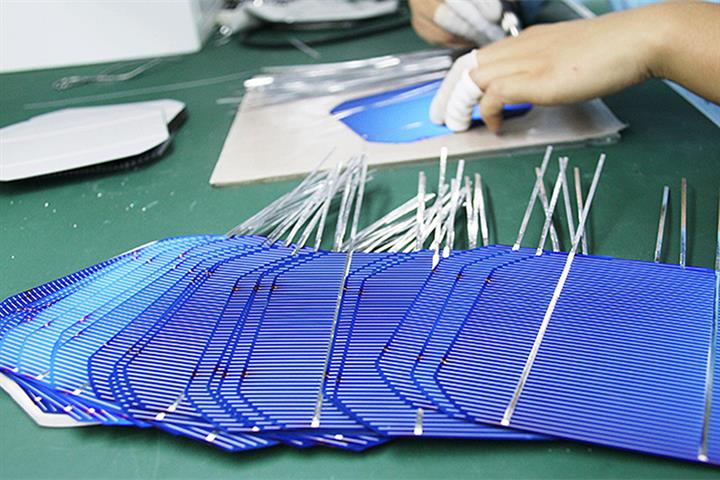

China’s Solar Firms Feel the Pinch as Raw Material Prices Soar(Yicai Global) July 4 -- China’s photovoltaic panel makers are being squeezed hard as the price of raw materials reaches a record high, and yet intense competition means that they are unable to pass the full extra cost onto the consumer. Diversification upstream is key to survival, an industry analyst said.

A surge in demand has kept silicon materials in short supply which pushed the average price to a record high of CNY285,000 (USD42,546) a ton last month, according to data released by the Silicon Industry of China Nonferrous Metals Industry Association on June 29. In the first six months, although there were as much as 382,000 tons of silicon materials available for sale, it is still 20,000 tons below demand.

On top of this, some polycrystalline silicon makers’ unscheduled halts in production for maintenance in the first half, as well as other larger-than-expected shutdowns scheduled for the third quarter, have aggravated the problem further, according to the association.

This reinforces market expectations that the shortage will last for a while.

As a result, many silicon wafer makers have started to hike their prices. Industry giant Longi Green Energy Technology has raised the price of different wafers by over 6 percent each, the firm said on June 30. And rival TCL Zhonghuan Renewable Energy Technology said on July 1 that it is increasing the price of its wafers by between 4.7 percent and 6.6 percent.

Yet those at the end of the industrial chain, the solar panel makers, are unable to fully pass on the extra costs as their clients, the developers of solar power projects, are unlikely to accept a big hike in prices.

"In China’s PV sector, the further upstream you go, the higher the concentration rate, and the further downstream you go, the lower the density," said Hu Qimu, chief researcher at China Steel Corporation's economic research institute. This means leading raw material producers have more pricing power, and the end product makers have little say in pricing due to stiff competition. It will be difficult for them to make ends meet because of the ensuing price wars, he added.

"Many module makers have to bear the extra costs themselves and this will test their cash flow,” a new energy industry analyst told Yicai Global. "China is the world's biggest exporter of PV panels. But the slow receipt of overseas payments will pose a big challenge to these firms."

"Some changes have been made to our July production plan but we haven’t paused manufacturing yet as we are relatively resilient to soaring upstream prices for we also produce our own raw materials," a representative from solar panel giant Risen Energy said. "In the last two years, we have been expanding upstream to produce our own silicon materials and this has greatly cut our costs,” he said.

"To be in the driver's seat, Chinese PV firms need to position themselves across the industrial chain as market prices become more transparent," said Zhang Kun, executive president of solar product maker GCL System Integration Technology. It will become less possible to survive by just being involved in a single link in the chain.

Industry Makeover

The surging silicon wafer prices will definitely trigger an industry shakeup, another industry insider told Yicai Global. "Some second- and third-tier solar module plants may have to suspend production as the production costs will be very high if they don’t have access to their own supply of raw materials."

For now, those PV module makers that have their own source of raw materials are still operating as normal, at between 80 percent and 100 percent capacity. Those, though, that are less diversified can only afford to keep 70 percent to 80 percent of their capacity running, according to the industry body.

"Our solar module shipment targets for this year remain unchanged at between 50 GWs and 60 GWs as we are confident we can meet our clients’ needs," a person connected to Xi’an, central Shaanxi province-based Longi said.

Editors: Tang Shihua, Kim Taylor