China's First Foreign Capital-Controlled Securities Joint Ventures Start Operations in Shenzhen

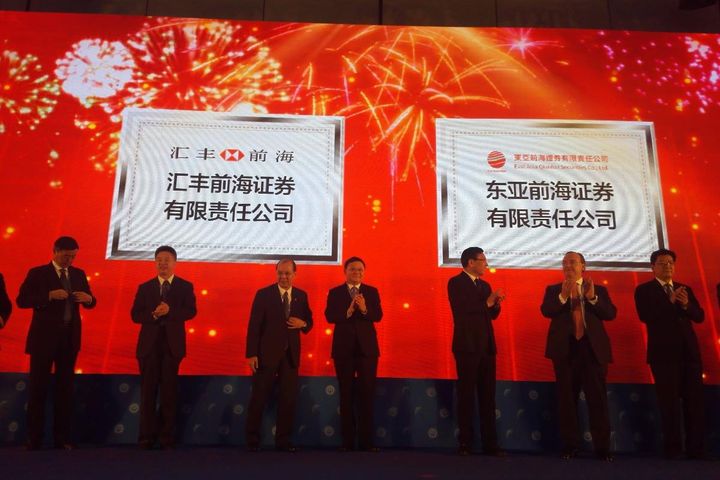

China's First Foreign Capital-Controlled Securities Joint Ventures Start Operations in Shenzhen(Yicai Global) Dec. 08 -- HSBC Holdings PLC [LON:HSBA] and the Bank of East Asia Ltd. (BEA) have obtained respective licenses from regulators to start operations at China's first joint venture securities companies in mainland China that are majority-owned by foreign banks.

The joint ventures, both set up in the Qianhai Free Trade Zone in China's tech capital Shenzhen, have received full licenses from the China Securities Regulatory Commission to offer securities services under the Supplement X framework.

Implemented in 2014, Supplement X is a cross-border arrangement aiming for closer economic cooperation between the mainland and its special administrative region of Hong Kong.

HSBC holds a 51 percent stake in its joint venture, HSBC Qianhai Securities Limited, which offers equity and debt sponsoring and underwriting, equity research and brokerage of locally listed securities, advising on domestic and cross-border corporate mergers and acquisitions as well as investment advisory.

East Asia Qianhai Securities Co. (EA Qianhai), a joint venture between BEA and Shenzhen Qianhai Financial Holdings, aims to serve as a one-stop integrated financial solutions to clients and act as a bridge between capital and sectors such as healthcare, consumer services, smart manufacturing, telecommunications and media, as well as infrastructure and real estate.

The joint venture, set up with registered capital of CNY1.5 billion (USD227 million), will offer services including securities brokerage, underwriting, asset management, and proprietary trading.

"BEA will leverage its broad customer base, rich experience in global business operations, and effective risk management capabilities to support the growth of EA Qianhai Securities, and act as a positive force in deepening financial cooperation between Shenzhen and Hong Kong," said Brian Li, executive director and deputy chief executive at BEA.