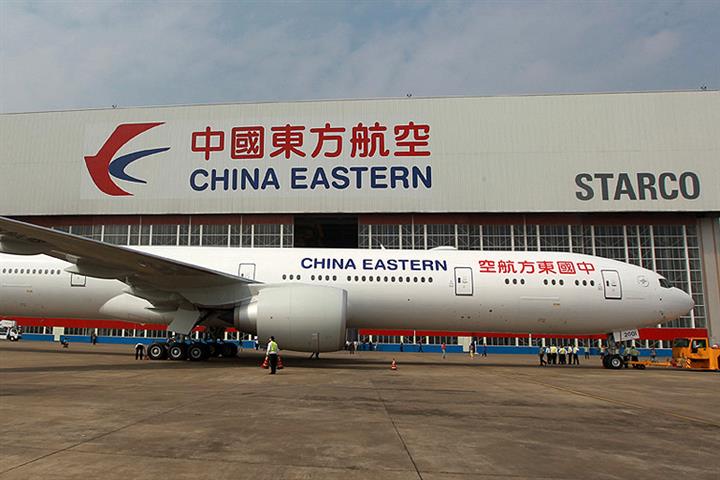

China Eastern Airlines Gets USD1.7 Billion Lifeline From Parent Firm

China Eastern Airlines Gets USD1.7 Billion Lifeline From Parent Firm(Yicai Global) Feb. 3 -- China Eastern Airlines, the country’s second largest carrier, has received a cash injection of CNY10.8 billion (USD1.7 billion) from its parent company to help tide it over the Covid-19 pandemic which has slashed passenger turnover by half.

China Eastern Air Holding will purchase 2.5 billion new shares at a price of CNY4.34 (USD0.67) apiece, the Shanghai-based unit said yesterday. This is a 5 percent discount on today’s closing price of CNY4.58. The private placement will boost Eastern Air Holding’s stake to 56.4 percent from 49.8 percent.

CNY6 billion will go towards paying off debts and the remainder will supplement working capital, it added.

The cash injection will help to reduce the costs of leveraging additional financing to meet the firm’s expenditure needs, it said. It will also provide a strong guarantee for China Eastern Airlines’ operations amid the pandemic, is a recognition of the company’s value and will protect the interests of small and medium shareholders.

The airline’s passenger turnover plunged 51.6 percent last year from the year before, according to company data. Its passenger load factor, or the proportion of bums on seats, was down 11.5 percentage points to 70 percent. The number of passengers dropped 42 percent to 77.5 million people.

As a result, the company is anticipating losses of as much as CNY12.5 billion (USD2 billion) last year, a huge reversal in fortune from the profit of CNY3.2 billion it made in 2019.

Editor: Kim Taylor