CATL Supplier XTC New Energy Reveals USD302 Million Plan to Retain Market Share

CATL Supplier XTC New Energy Reveals USD302 Million Plan to Retain Market Share(Yicai Global) Dec. 15 -- China's XTC New Energy Materials, which counts BYD and Contemporary Amperex Technology as some of its clients, announced two investment plans totaling CNY1.9 billion (USD302 million) to solidify its position in the widening battery materials market.

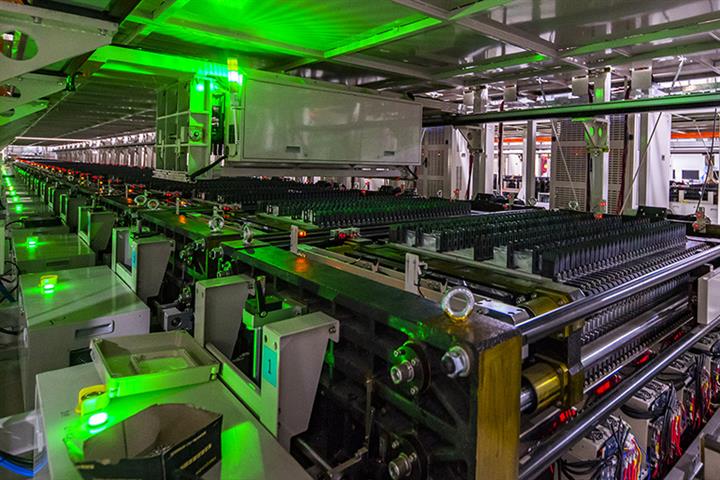

XTC New Energy will team with two partners to invest CNY927 million (USD146 million) to build a plant in southwestern China, the unit of metals producer Xiamen Tungsten said in a statement yesterday. The facility will produce 100,000 tons of lithium iron phosphate per year.

Investing in a large lithium iron phosphate cathode material project will help XTC New Energy to consolidate its leading position in the market and enhance its resilience, it said.

Moreover, the firm intends to invest CNY997 million to construct a new workshop with an annual output of 30,000 tons of high-nickel ternary cathode materials at an existing production base in Xiamen, it added.

Lithium iron phosphate and ternary materials are two mainstream cathode materials for new energy vehicle batteries. The market share of the former has increased over recent years due to the high energy density and safety affiliated with lithium iron phosphate.

Most of XTC New Energy's clients buy both cathode materials from it and some of its customers are Gotion High-tech and China Lithium Battery Technology, the supplier said when it was going public on Shanghai's Star Market in July.

The company has an 83-percent stake in the project in Sichuan province. The first phase of the construction project should be ready by April 2023, involving an annual capacity of 20,000 tons of lithium iron phosphate.

After the Xiamen upgrade is finished in September 2023, the production base's total capacity should reach 70,000 tons of ternary cathode materials per year.

The announcement prompted tepid stock price movements. XTC New Energy’s share price [SHA: 688778] rose as much as 2.8 percent to CNY119.65 (USD18.80) intraday.

Editor: Emmi Laine, Xiao Yi