BYD Semiconductor to Raise USD266 Million, List Before BYD’s Battery Unit

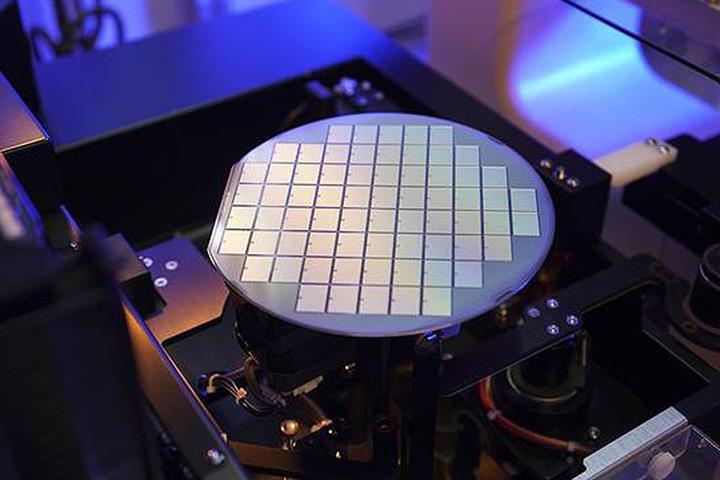

BYD Semiconductor to Raise USD266 Million, List Before BYD’s Battery Unit(Yicai Global) May 27 -- BYD’s semiconductor unit has raised CNY1.9 billion (USD266 million) as the electric carmaker shifts its focus to wafers following a setback in new-energy vehicle and power battery said, and plans to list its semiconductor arm ahead of its battery-making subsidiary.

Sequoia Capital, China Capital Investment Group and SDIC Fund Management led the fundraiser with support from Himalaya capital and other domestic and foreign investment institutions, BYD said in a statement yesterday. The backers, of which SDIC and Himalaya are already investors in parent BYD, picked up a combined 20.21 percent stake in BYD Semiconductor at a valuation of CNY10 billion.

Shares in BYD [SHE:002594] started higher but were down 0.86 percent at CNY57.80 (USD8.08) as of 11.22 a.m.

The carmaker plans to spin off the semiconductor unit, which runs an entire wafer-making supply chain, and will do so ahead of its battery business, a BYD insider told Yicai Global. BYD sold just 35,187 electric cars from January through April, down nearly 64 percent annually. It also fell to sixth from third in the global rankings by power battery loading capacity in the first quarter and net profit fell by almost 85 percent to CNY113 million (USD15.8 million).

The target will use the funds for research and recruitment and to supplement working capital and buy assets, according to the statement.

Editor: James Boynton