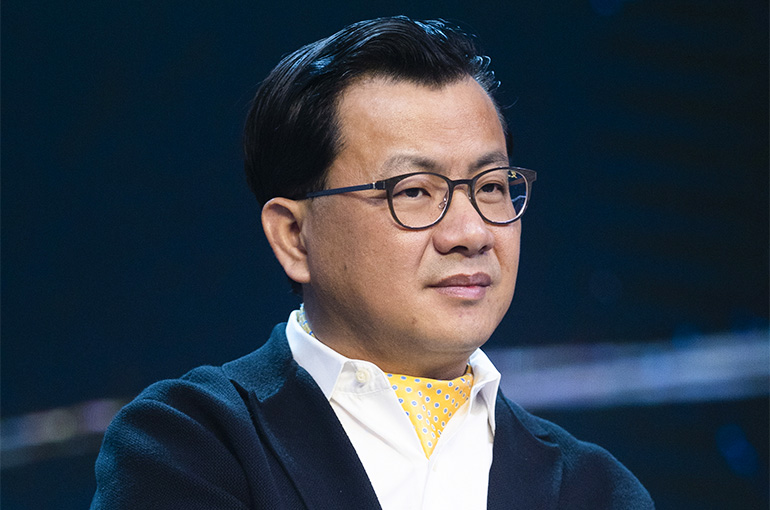

Alibaba Ex-CEO David Wei Joins Sansure Board as Covid-19 Test Kit Maker Seeks New Way Forward

Alibaba Ex-CEO David Wei Joins Sansure Board as Covid-19 Test Kit Maker Seeks New Way Forward(Yicai) Dec. 3 -- David Wei, former chief executive officer of Chinese e-commerce giant Alibaba Group Holdings, has been invited to join Sansure Biotech as a board director, to help the in vitro diagnostic solution provider, which rose to prominence through its Covid-19 test kits, develop new paths for growth.

Wei, who led Alibaba from 2006 to 2011 and successfully spearheaded its listing in Hong Kong in 2007, was nominated by Sansure's Chairman and General Manager Dai Lizhong, the Changsha-based firm said on Nov. 30. His appointment on the board will be formalized after approval at a shareholder meeting. Wei currently does not hold any shares, either directly or indirectly, in Sansure.

As part of the shake-up, Sansure said on the same day that it is transferring two senior executives to act as general managers of two of its subsidiaries to strengthen the synergy between the parent firm and its units. Director and Deputy General Manager Fan Xu and research and development expert Ji Bozhi will be reassigned and will no longer hold their original positions in the parent company.

The introduction of Hangzhou-based Alibaba’s former CEO and the reassignment of core technical personnel to subsidiaries are aimed at accelerating the firm's transition towards platformization and internationalization, the National Business Daily reported yesterday, citing a company insider.

54-year-old Wei founded Vision Knight Capital in 2011 when he left Alibaba. The private equity fund, which focuses on new consumption, cross-border e-commerce and cutting-edge tech, has more than CNY17 billion (USD2.3 billion) in assets under management. At the end of last year, Vision Knight linked arms with another venture capital fund, Purple Bull Startups, to set up a healthcare-focused fund, marking its first foray into the medical sector.

Sansure, founded in 2008, did extremely well during the Covid-19 pandemic thanks to its nucleic acid testing kits. The firm’s net profit surged 65 times in 2020 from the year before to CNY2.6 billion (USD356.3 million), while revenue soared 12-fold to CNY4.8 billion (USD657.8 million).

But these figures have dwindled considerably since the end of the pandemic and the drop in testing. Last year, Sansure logged net profit of just CNY364 million (USD50 million) on revenue of CNY1 billion (USD137 million).

As a result, Sansure, which went public on the Shanghai Stock Exchange's Nasdaq-style Star Market in 2020, is actively seeking growth beyond Covid-19 testing. In recent years it has invested in Shenzhen-based genomics sequencing company GeneMind Biosciences, and is collaborating with overseas technology firms such as the UK’s QuantuMDx and the US’ First Light Diagnostics.

Editor: Kim Taylor