Shanghai’s New Global Reinsurance Trading Market to Attract More Overseas Business

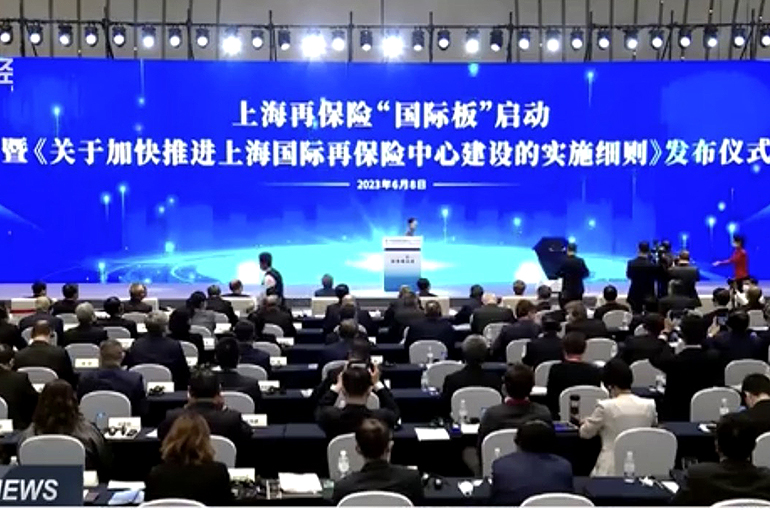

Shanghai’s New Global Reinsurance Trading Market to Attract More Overseas Business(Yicai Global) June 9 -- Shanghai’s international board for reinsurance trading, which was inaugurated at the 14th Lujiazui Forum yesterday, will help bring in more reinsurance business, which refers to the insuring of other insurers’ products to diversify risk, from abroad and boost the sector.

The launch of the reinsurance international board will help the Chinese insurance industry transform into a ‘two-way’ model from the current ‘one-way’ model, a senior executive at a reinsurer said.

The trade deficit in reinsurance services is very noticeable, the person said. For instance, last year, the mainland transferred CNY112 billion (USD15.7 billion) worth of insurance premiums to other countries and regions, while only CNY28.3 billion (USD4 billion) worth was incoming.

Since 2019, because of the Covid-19 pandemic, geopolitical conflicts, inflation and many other factors, the premium rates of both ordinary insurance and reinsurance have been rising worldwide, but the rates on the mainland are relatively stable, market insiders said.

The big gap in premium rates, the need for more foreign insurers to reinsure on the mainland, the launch of the international board for reinsurance trading plus various incentive measures should in theory attract overseas insurance firms to buy more Chinese reinsurance policies, the executive said.

However, insurers should be aware of the risks of conducting business overseas, such as large insurance payouts due to overseas disasters and the potential increase in liabilities caused by foreign inflation, market insiders said.

To meet Shanghai’s aspirations to build itself into a global reinsurance hub, a document with 22 measures to support reinsurance was also issued today.

The Shanghai Insurance Exchange will link arms with various parties to formulate regulations on the registration system, exchange rules, fund settlement and cross-border facilitation to promote the reinsurance sector’s online and smart transformation via the blockchain technologies, a manager told Yicai Global.

Information about participants in the reinsurance board as well as their business targets will be disclosed, and information about risks would be shared, so as to prevent risks such as fundraising for terrorists and money laundering, the exchange said.

Editors: Zhang Yushuo, Kim Taylor