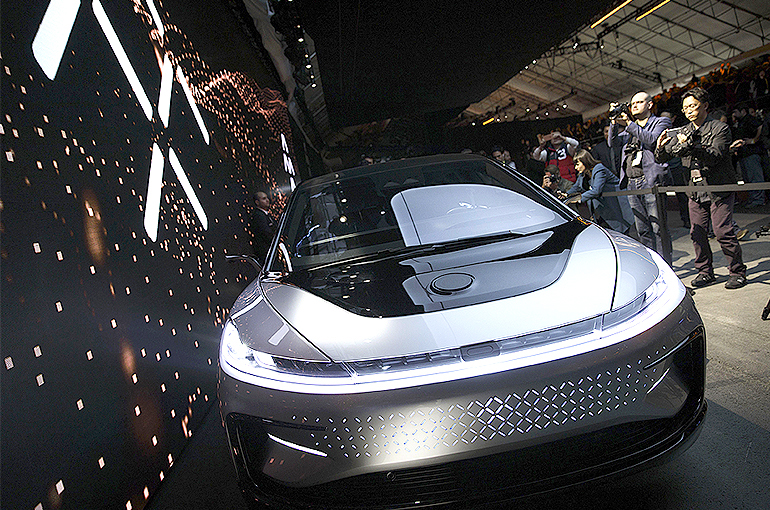

Faraday Future’s Shares Soar After NEV Maker Sells USD100 Million of Bonds to Fund First Deliveries

Faraday Future’s Shares Soar After NEV Maker Sells USD100 Million of Bonds to Fund First Deliveries(Yicai Global) May 10 -- Shares of Faraday Future Intelligent Electric surged after the new energy vehicle maker that is fighting to deliver its first cars amid Chinese founder Jia Yueting's financial troubles said it gained USD100 million via bonds that can later be turned into equity but come with no special pecking order in case of liquidation.

FF [NASDAQ: FFIE] was 14.4 percent up in pre-market trading as of 8.51 p.m. after diving 7.9 percent to close at US 24 cents in New York yesterday, losing almost 90 percent of the stock value over the past 12 months.

Some of the major investors that bought FF's unsecured convertible notes are Metaverse Horizon, an investment fund that counts a partnership of FF's senior executives as some of its investors, and V W Investment Holding, an affiliate of a long-term shareholder, the Los Angeles-based startup said in a statement late yesterday.

Founded in 2014, FF's performance has been weighed down by Jia's financial problems as the No. 1 mass-produced FF 91, the brand's first model, rolled off the production line only last month. Deliveries should begin late this month.

The company plans to reveal the sales price and specifications of the electric sport-utility vehicle on May 30, Chinese business media outlet Speed Daily reported today, citing an insider.

The brand is scheming to open its first flagship store in Shanghai or Wuhan, the insider said, adding that the firm is preparing to build its first global experience center in the lavish city of Beverly Hills, California, and choosing a site for its flagship store in New York.

FF recorded a net loss of USD522 million last year, up almost 7 percent from 2021, according to its annual earnings report. Since day one, the firm has burned through almost USD3.5 billion in funding.

Editor: Emmi Laine, Xiao Yi